sales tax calculator tucson az

Real property tax on median home. Integrate Vertex seamlessly to the systems you already use.

How To Calculate Cannabis Taxes At Your Dispensary

The current total local sales tax rate in Tucson Estates AZ is 6100.

. There is no applicable special tax. The minimum combined 2022 sales tax rate for Tucson Arizona is. With local taxes the total sales tax rate is between.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. The December 2020 total local sales tax rate was also 6100. Sales Tax Calculator Sales Tax Table Arizona AZ Sales Tax Rates by City T The state sales tax rate in Arizonais 5600.

Check your city tax rate from. 560 Arizona State Sales Tax -048. Ad Find Out Sales Tax Rates For Free.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Tucson Sales Tax Rates for 2022 Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. 2020 rates included for use while preparing your income tax deduction.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. Depending on local municipalities the total tax rate can be as high as 112. Sales Tax State Local Sales Tax on Food.

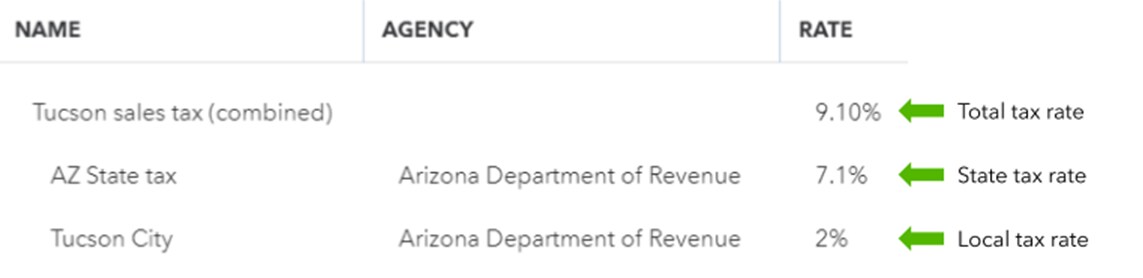

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Choose the Sales Tax Rate from the drop-down list. The 85703 Tucson Arizona general sales tax rate is 87.

The sales tax jurisdiction. Sales tax in Tucson Arizona is currently 86. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax.

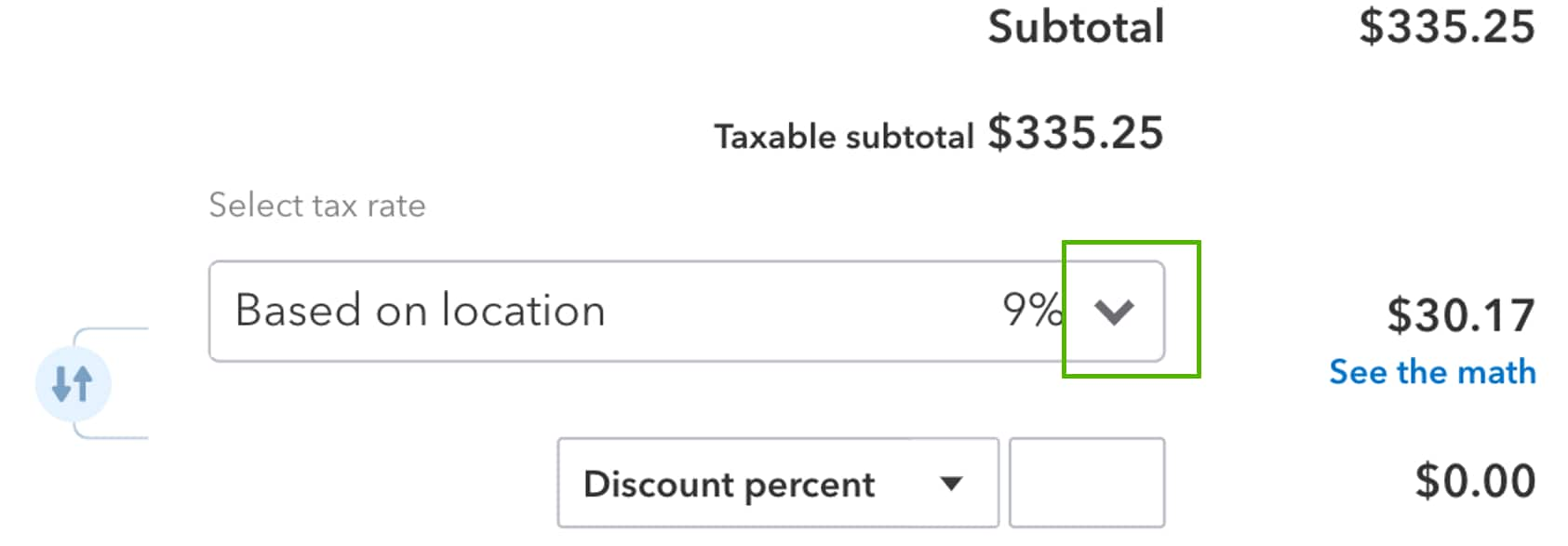

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Enter your Amount in the respected text field. This rate includes any state county city and local sales taxes.

This is the total of state county and city sales tax rates. Fast Easy Tax Solutions. Fields marked with are.

How to use Tucson Sales Tax Calculator. The December 2020 total local sales tax rate was also 11100. Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality.

Tucson Estates AZ Sales Tax Rate. Tax Paid Out of State. South Tucson AZ Sales Tax Rate The current total local sales tax rate in South Tucson AZ is 11100.

Just enter the five-digit zip code. Price of Accessories Additions Trade-In Value. The December 2020 total local sales tax rate was also 8700.

The Arizona sales tax rate is currently. This will give you the sales tax you. Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. The County sales tax. The latest sales tax rate for Corona de Tucson AZ.

Integrate Vertex seamlessly to the systems you already use. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Fha Streamline Refinance Fha Streamline Refinance Fha Mortgage Fha

Capital Gains Tax Calculator 2022 Casaplorer

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

State And Local Sales Taxes In 2012 Tax Foundation

Is Food Taxable In Arizona Taxjar

Nj Car Sales Tax Everything You Need To Know

Arizona Sales Tax Small Business Guide Truic

2021 Arizona Car Sales Tax Calculator Valley Chevy

Florida Income Tax Calculator Smartasset

Arizona Sales Reverse Sales Tax Calculator Dremployee

How To Calculate Cannabis Taxes At Your Dispensary

How Does Sales Tax Work On Fitness Memberships Taxjar

Arizona Sales Tax Rates By City County 2022

Arizona Sales Tax Small Business Guide Truic

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Property Taxes In Arizona Lexology

Monday Map Sales Tax Exemptions For Groceries Tax Foundation