ny highway use tax return instructions

Highway Use Tax HUT Web File is the easiest and fastest way to file a highway use tax return and make a payment. Be sure to use the proper tables for the period you are reporting.

You can also file now and schedule your electronic payment for a date no later.

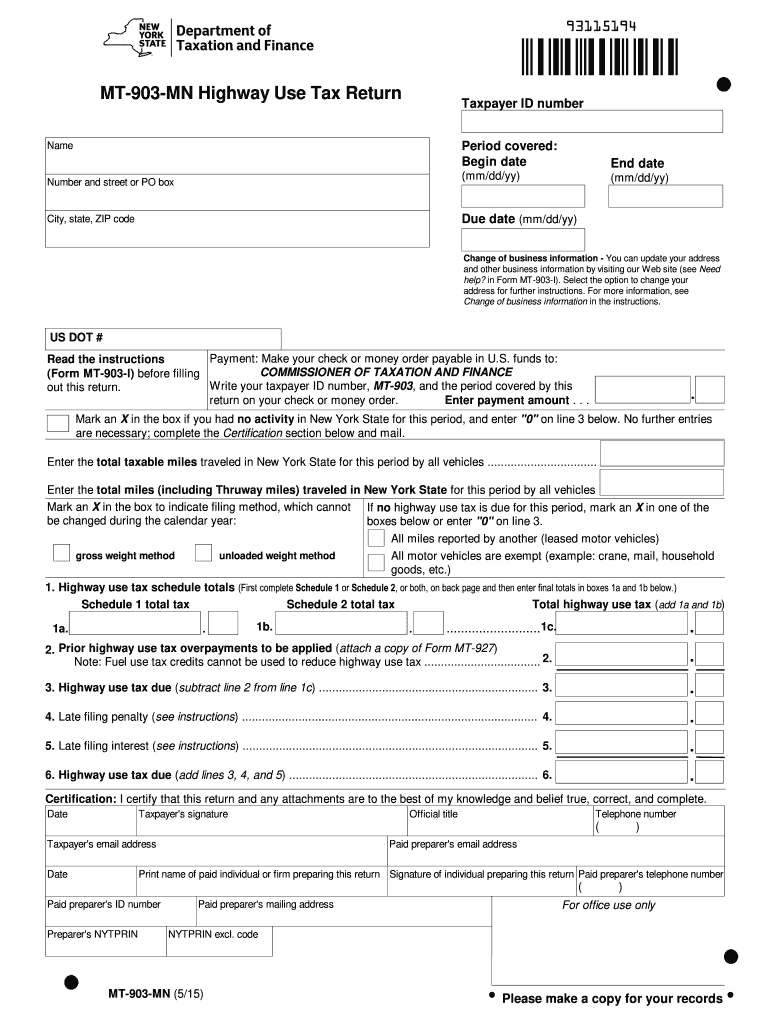

. Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by buses or other. 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. Taxpayer ID number Name Period covered Begin date mmddyy End date mmddyy Number and street or PO box Due date mmddyy City state ZIP code If there are any changes in your business name ID.

To compute the tax due on the schedules below see the Tax rate tables for highway use tax on page 4 of Form MT-903-I Instructions for Form MT-903. Youll receive an electronic confirmation number with the date and time you filed your return. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due.

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more. Ny may request a copy of your cp575 this is the document that the irs issues when your company is assigned an fein number once you have an active nyhut account it is your responsibility to file the quarterly tax returns same deadlines as ifta. New York State Department of Taxation and Finance.

Final return Amended return Mark an Xin the applicable box. 18 rows Highway usefuel use tax IFTA Form number Instructions Form title. New York State Department of Taxation and Finance.

Claim for highway use tax hut refund. For more information see TB-HU-260 Filing Requirements for Highway Use Tax. 90300101220094 Department of Taxation and Finance.

MT-903-MN Highway Use Tax Return. If you have any questions please see the Need help. 122 Legal name Mailing address Number and street or PO Box City State ZIP code.

Form MT-903 is filed monthly annually or quarterly based on the amount of the previous full calendar year s total highway use tax liability Monthly - more than 4 000 Annually - 250 or less with Tax Department approval Quarterly - all others including carriers not subject to tax in the preceding calendar year You may request a change of filing status based on your previous year. Miles including New York State Thruway miles traveled in New York State for this period by all vehicles. Instructions for Form MT-903 Highway Use Tax Return mt903i Keywords InstructionsForm MT-903HighwayUse TaxHighway Use Tax.

Do not report mileage traveled on the toll-paid portion of the New York State Thruway or mileage traveled by. Instructions for Form MT-903. Box on Form MT-903-I Indicate filing method which cannotbe changed during the calendar year gross.

Figure and pay the tax due if during the. This revision if you need to file a return for a tax period that began on or before June 30 2021. Use Form 2290 to.

The time to renew is over. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use. Instructions for form 2290 heavy highway vehicle use tax return 0719 06152020 inst 2290.

Use Form DTF-406 to request a refund of the highway use tax for. This July 2021 revision is for the tax period beginning on July 1 2021 and ending on June 30 2022. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due.

2021 IFTA credentials are valid through February 28 2022. New York State Department of Taxation and Finance Instructions for Form MT-903 Highway Use Tax Return MT-903-I 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. A credit for overpayment as shown on Form MT-927 Highway Use Tax HUT Overpayment Adjustment Notice a duplicate payment made for a certificate of registration or an overpayment shown on your amended Form MT-903 Highway Use Tax Return.

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor. Number mailing or business address telephone number or ownerofficer. Please review the information below.

Highway Use Tax Web File You can only access this application through your Online Services account. If highway use tax is due you must first complete Schedule 1 or Schedule 2 or both on the back of the form to calculate the amount of tax due. New York State highway use tax TMT New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

Highway Use Tax Return. Form MT-903 Highway Use Tax Return Revised 122. At wwwtaxnygov or call 518 457-5431.

If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Publication 538 708 1 This publication is a guide to the New York State highway use tax and includes information regarding vehicles subject to tax registration requirements exemptions record keeping returns and special provisions. Notices as of February 22 2022.

Highway Use Tax ReturnMT-903. The tax rate is based on the weight of the motor vehicle. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate.

Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period. Do not report mileage traveled on the tollpaid portion of the New York State. The form instructions or publication you are looking for begins after this coversheet.

Miles traveled in New York State for this period by all vehicles. If you need 2022 IFTA credentials you must file Form IFTA-21 New York State International Fuel Tax Agreement IFTA Application.

Ny Ifta 21 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Our Bravest Collection Is All About The American Firefighting Tradition Found In Cities Across The Usa While Cr Red Fire Fire Service Promote Small Business

The 4 Key Processes Enabled By A Transport Management System Tms Transportation System Logistics

Pink Sky Pink Sky Spain Aesthetics Road Trip

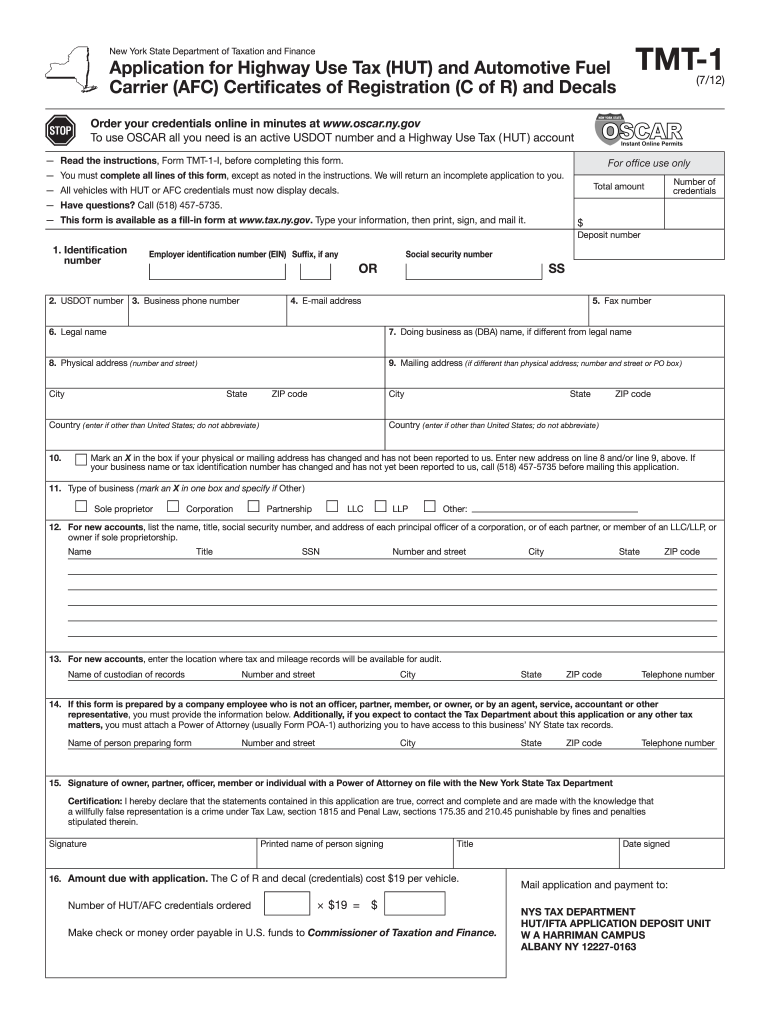

2011 Form Ny Tmt 1 Fill Online Printable Fillable Blank Pdffiller

2021 Instructions For Schedule H 2021 Internal Revenue Service

Notary Public Address Change Notary Public Notary Public

Mt 903 I Fill Online Printable Fillable Blank Pdffiller

Notary Public Address Change Notary Public Notary Public

Judicial Council Of California Civil Jury Instructions Caci Lexisnexis Store

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Janitorial Services Sample Proposal Janitorial Services Janitorial Cleaning Services Janitorial

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Colorado Jury Instructions Civil Lexisnexis Store

2015 2022 Form Ny Dtf Mt 903 Mn Fill Online Printable Fillable Blank Pdffiller

Best Truck Driving Jobs Images On Pinterest Driving Truck Driving Jobs Trucks Truck Driver Jobs